social security tax calculator

The remaining states do not tax Social Security income. Social Security Taxes are based on employee wages.

Payroll Paycheck Calculator Wave

These days theres a lot of doom and gloom about Social Securitys solvency - or lack thereof.

. You can have taxes withheld. Did you know that up to 85 of your Social Security Benefits may be subject to income tax. Social Security taxable benefit calculator Filing Status Single Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding SS.

Social Security taxable benefit calculator Filing Status Single Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099 Enter taxable. The calculator works for all types of Social Security benefits. Social Security Calculator The US.

Social Security Benefits Tax Calculator Use the calculator below to know the amount if your social security benefit that you must include in the tax return as taxable. Social Security Quick Calculator Benefit Calculators Frequently Asked Questions Benefit estimates depend on your date of birth and on your earnings history. This percentage is a combination of Social Security and Medicare tax.

Social Security Tax and Withholding Calculator. Use this Self-Employment Tax Calculator to estimate your. The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in.

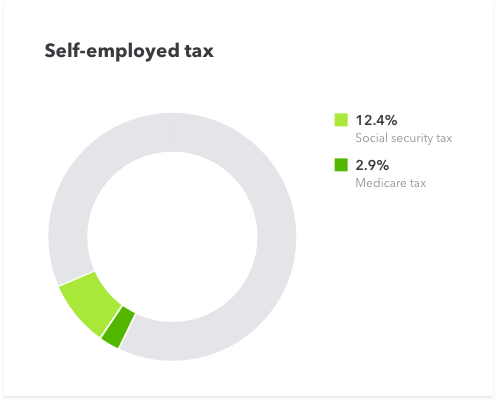

How to Calculate My Social Security Benefits You can use the Money Help Center calculator to determine how much Social Security you will get and how income tax may impact your. The self-employment tax rate is 153. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The tool has features specially tailored to the unique needs of retirees receiving. It doesnt matter whether youre receiving retirement income benefits disability benefits spousal benefits or.

If this is the case you may want to consider repositioning some of your other income to minimize. While they are all useful there currently isnt a way to help determine the ideal. Enter your expected earnings for 2022.

Self-employed workers are taxed at 153 of the net profit. Calculate My Social Security Income. The advantage of using this calculator to determine the potential tax implications of your Social Security benefits is that you can plan accordingly.

The rate consists of two parts. For each age we calculate. There are two components of social security.

How To Calculate Your Paid Family And Medical Leave Withholding. To calculate the amount of Paid Family Medical Leave withheld from your paycheck multiply your gross. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator.

Social Security wages reduce the limit for self-employment income. Social Security website provides calculators for various purposes.

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Llc Tax Calculator Definitive Small Business Tax Estimator

2023 Fica Calculator Calculate Social Security And Medicare Contributions

Tax Calculator Including Social Security Medicare Ppt Powerpoint Presentation Outline Images Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Social Security Tax Calculator Are Your Retirement Benefits Taxable Fox Business

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Is Social Security Taxable Comprehensive Guide Examples

Tax Calculator Including Social Security Medicare Ppt Powerpoint Presentation Outline Images Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Federal Income Tax Calculator Estimator For 2022 Taxes

Pay For Some Will Decrease To Cover Social Security Deferrals 315th Airlift Wing Article Display

Calculating Taxes On Social Security Benefits

Self Employed Tax Software Calculator Quickbooks

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified

Fica Tax Guide 2022 Payroll Tax Rates Definition Smartasset

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)